Economic Impact

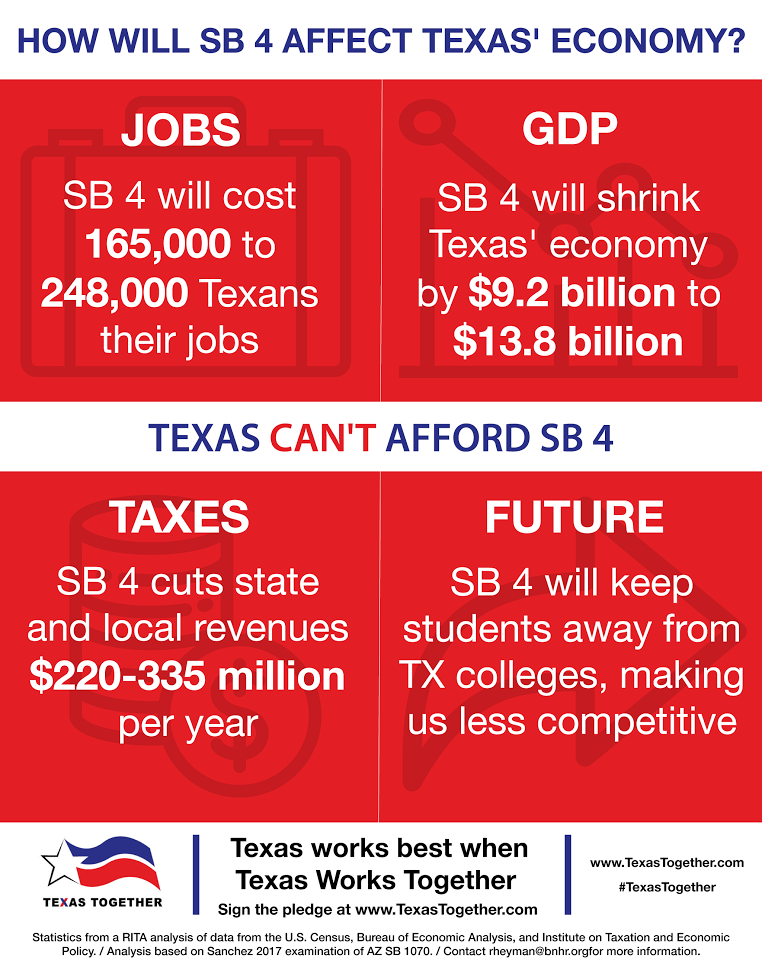

SB 4 will result in significant economic costs, related to jobs, earnings, taxes and -GDP, if 10 to 15 percent of undocumented immigrants leave Texas.

Methodology and Sources

To estimate the potential economic cost of Texas SB4, we first obtained data from the 2015 American Community Survey (ACS) using the Integrated Public Use Microdata Series (IPUMS).(*1) We then applied the methodological approach outlined by Harvard University economist George Borjas to arrive at an estimate of the undocumented immigrant population in Texas.(*2) After that, we identified the top 10 industries where undocumented immigrants work in the state (accounting for 57% of undocumented workers), and created an aggregate estimate category for undocumented immigrants working in other industries (accounting for the other 43% of undocumented workers).

By using the above data and the industry multipliers from Regional Input-Output Modeling System (RIMS II), we then estimated the total loss in jobs, worker earnings, and gross domestic product (GDP) in Texas if 10 or 15 percent of undocumented immigrants leave the state.(*3) RIMS II is an economic impact tool developed by the Bureau of Economic Analysis and is widely used in economic contribution studies.

The estimate that 10 percent of undocumented immigrants would leave Texas is based on the study by Gonzalo Sanchez of Texas A&M University.(*4) His research on Arizona SB1070, a similarly controversial piece legislation in Arizona, found that the population of non-citizen Hispanics decreased by 10 to 15 percent after the bill passed. The RIMS multipliers provided the data that we needed to calculate the direct, indirect, and induced economic cost of such departures. The direct cost comes from the impact on the top 10 industries that would be directly affected by the loss of undocumented workers, and the indirect cost is the impact on the industries that provide goods and services to the above 10 industries. Induced cost, on the other hand, is the impact on industries affected across the board because of loss of consumption from undocumented workers.

Aside from the loss of jobs, worker earnings, and GDP, we also calculated the potential loss in federal, state, and local tax revenues if 10 or 15 percent of undocumented immigrant workers leave the state. We estimated state and local taxes by using statistical methods for estimating the distribution of undocumented households across the income distribution in Texas and calculated aggregate figures using the effective tax rates estimates produced by the Institute on Taxation and Economic Policy (ITEP)(*5). For federal tax rate estimates, we used data released by the Congressional Budget Office in 2014(*6) and calculated the amount paid in federal tax based on the tax bracket a given household fell into.

1) University of Minnesota, “IPUMS-USA,” 2014 2005, www.ipums.org.

2) George J. Borjas, “The Labor Supply of Undocumented Immigrants,” NBER Working Paper (National Bureau of Economic Research, Inc, 2016), https://ideas.repec.org/p/nbr/nberwo/22102.html.

3) US Department of Commerce, “RIMS II Multipliers,” Bureau of Economic Analysis, accessed June 28, 2017, https://www.bea.gov/regional/rims/rimsii/.

4) Gonzalo E. Sánchez, (2017) “The short-term response of the Hispanic noncitizen population to anti-illegal immigration legislation: The case of Arizona SB 1070”, Journal of Economics, Finance and Administrative Science, Vol. 22 Issue: 42, pp.25-36, https://doi.org/10.1108/JEFAS-02-2017-0034

5) Institute on Taxation and Economic Policy, “Who Pays: Texas”, 2015. https://itep.org/whopays/texas/

6) Congressional Budget Office, “The Distribution of Household Income and Federal Taxes 2011”, November 2014. https://www.cbo.gov/sites/default/files/113th-congress-2013-2014/reports/49440-distribution-income-and-taxes-2.pdf

SB 4 already is having a chilling effect on the Texas economy, particularly the convention and tourism industry, a major industry.

The Perryman Group recently estimated that when multiplier effects are considered, the total, Indirect benefits of travel and tourism industries include more than $128.9 billion in annual gross product and 1.4 million permanent jobs in Texas (as of 2016). In addition, travel and tourism was found to generate an estimated $7.0 billion in yearly State tax revenue and $3.3 billion in local tax revenue across the state.

This industry already has received cancellations or threats to cancel future meetings in Texas, specifically because of SB 4. (This does not include cancellations and threats related to the “bathroom bills.) The major organizations that have decided to bypass Texas include:

- The American Immigration Lawyers Association with more than 3,000 attendees

- The Association of American Law Schools with 600 legal educators

- National Hispanic Caucus of State Legislators with 200 attendees – 200 people

- International Society for Technology in Education advised Visit San Antonio that it is considering relocating its 2021 and 2025 conferences because of the SB 4 law and the pending “bathroom bill.” ISTE brings more than 20,000 people to Texas plus more than 500 exhibiting companies, including many Fortune 500 companies and startups.